Mostly due to pandemic-related circumstances, the domestic trucking industry was wrought with hardships and conflict this past year. Increased rates, limited availability and lack of free time are expected to continue well into Q2.

The overly congested ports are the main contributor to the bottleneck of acquiring truckers, but other factors are coming to light which are yielding even more problems than initially anticipated.

Slower Circulation of Containers

The main factor driving port congestion is not that vessels lack space, but slow circulation of containers is disrupting the flow. Reduced labor productivity at warehouses is a key factor to the slow movement of containers. Until normal container flow can resume, delays and congestion are to be expected. The fact that volume is also increasing is moving the equilibrium timeline even farther into the future, as it is creating an upheaval that will takes months to balance. Just when the system needed more capacity, increased utilization and reduced circulation disrupted the process. The trucking industry plays a key role in helping to manage the container utilization process, as they are responsible for the movement in and out of ports. When there is a hiccup in this lane, it is felt throughout the shipping process. It is not a matter of creating more containers, rather waiting for the balance to return to normal.

At the start of the pandemic lanes shut down, ships slowed down, and cargo stopped moving. When everything started up again, it was assumed operations could return to normal, as the whole world was experiencing the same kind of lags. However, when shipping resumed, there were many new factors that created a ripple effect of problems, trucking being one of the hardest hit players. Less personnel, more volume, unprecedented rate requests and a mountain of backlog all impacted the world-wide logistics flow.

Loss of Jobs despite high demand

The U.S. department of labor reported a loss of nearly 2,500 jobs in December of the truck-for-hire business, despite the industry’s high demand. As well, truckers are especially hit with contracting COVID due to travel and multiple interactions made in a day. With the U.S’s necessary guidelines of quarantine, a further loss in personnel has had an especially adverse impact on the trucking field. Though in recent months the onboarding of truckers has risen, the impact of losing mass numbers is still affecting the logistics of delivery.

Spot Rate Market

Another reason trucking rates have been climbing is related to the increase in the frequency of spot-rate requests. Most trucking companies can contribute, at most, 30% of volume to the spot market. Because of this, there are less truckers allocated to this service. With U.S. imports of retail goods in high demand due to the pandemic, the shipping industry is being met with what appears to be fewer truckers than usual; but on deeper analysis truck numbers simply are nowhere near where they should be. There will be a push to have less contract rates and more spot rates to counteract this phenomenon, but until then trucks are not being utilized to optimal capacity, leading to high rates and few available bookings.

Despite the issues above, ports are still experiencing massive congestion with so much backlog that there is nowhere to put containers coming off the vessels. The trucks cannot come in to gather cargo, nor can they bring empty containers back. Ports such as Los Angeles and Long Beach are especially hard hit, as they have had one of the highest upticks in COVID cases, and their appointment policies makes timelines even more constrained. The Chinese New Year will create a small lull in imports, which will hopefully allow the ports to get a handle on the congestion, but the impact of this will not be seen for months to come.

Trucking companies are dealing with keeping their employees safe, while still delivering cargo across the U.S. With extended lead time in picking up cargo, the lack of truckers available to book, and the high demand seen nationally, rates will continue to rise until an adjustment has been made to offset some of the effects of COVID.

Our team at Eagle/EGL Maritime works directly with trucking companies and has built strong relationships, giving us an advantage in bookings.

Our team is dedicated to finding the lowest rates, while still guaranteeing availability.

Though many of the challenges faced are beyond our control, we are well suited to provide bespoke, flexible solutions.

If there is an issue securing a trucker, or if clarity is needed on rates, please contact an Eagle/EGL Maritime employee. Our team is here to help ensure seamless customer service and shed light on any issues.

EGL/Eagle Maritime is always ready to navigate the world!

Thank you for your continued support and understanding.

Sincerely,

The Entire Team at Eagle/EGL Maritime

Our Blog

International demand for freight exceeds the current capabilities of the worldwide supply chain. Problems range from equipment and space shortages to schedule inconsistencies; all industry players are affected.

We now see a high demand in place for truckers, warehouse workers, longshoremen, etc. and in turn for shipping equipment - all key components in maintaining the flow of goods into and out of the country.

U.S. ports are running at 90% or higher capacity. Ports and rails have no space remaining to put containers. They cannot stage for exporting vessels and have no space to store import containers trying to discharge. This counterproductive problem is creating mass congestion at ports leading to longer processing times, especially for drivers. Truckers are starting to charge for additional wait time at ports, driving up costs. In extreme cases, some truckers are abandoning cargo for both imports and exports. The worst impacted areas in the U.S. are being reported as Los Angeles/Long Beach and New York. Below is a breakdown of specific timeline extensions and major issues in these areas.

Los Angeles/Long Beach

• There are more than 40 ships at anchor waiting to berth at LA/ LGB as of Friday, January 15th

• All terminals are expected to remain congested until late February

• Most terminals are understaffed and are dealing with COVID related shift issues affecting turnaround-time for truckers, inter terminal transfers, and appointments for gate transactions

• Rail Operations in Long Beach can be extended up to 10 days/18 days in LA

New York/New Jersey

• Multi-day delays are expected at Maher Terminal and APM Terminal due to birth congestion

• Crewmembers are mandated to be tested for COVID prior to bringing the vessel to dock, creating longer wait times

• Dwell time has increased in response to the spike in imports

• Gate turn times for truckers has increased as a direct result of COVID restrictions and policies

Overall, import delays will cause export vessels to be delayed as well. It is not unheard of that shipments are rolled to a different working vessel or a projected vessel to accommodate space issues. In extreme cases vessels can be canceled altogether.

Terminals are not the only bottleneck in the equation- Rails are operating but have new weight restrictions and that are affecting timelines and pricing as well. This, paired with the worker shortage found in all aspects of shipping, is creating a national issue in the transportation of goods. See below for other major delays and difficulties.

U.S. Port Congestion

• Savannah has 8+ vessels waiting to berth

• New York is currently seeing a 5 day delay to berth

• Los Angeles / Long Beach is currently seeing a 3 – 4 week delay to berth

• Oakland is currently seeing a 1-3 day delay to berth as well as dealing with heavy labor shortages

• Seattle is currently seeing a 1-3 day delay to berth as well as operating at 100% capacity

• Prince Rupert is currently seeing a 4-5 day delay to berth as well as operation at 110% capacity

• Vancouver’s anchorage is full, with a waiting period of 5-7 days to berth as well as operating at 100% capacity

Chassis Pools

• Chassis availability is becoming extremely limited

• Issues can be found mostly in the North East, West Coast and Gulf States

• Price increases are being experienced across the board

Railway Congestion

• Rail operations in Los Angeles can be extended up to 18 days

• Halifax, CA - 11 day delay

• Montreal, CA – 9 day delay

• Vancouver, CA – 16 day delay

• New York, NY – 10 day delay

• Charleston, SC; Savannah, GA; Norfolk, VA; Kansas City, MO; Chicago, IL; Memphis, TN; Council Bluff, IA; Detroit, MI – all 7-9 day delay

While the current situation is critical it is not completely out of control, we are working hard to ensure all our customers and partners are being provided with the best customer service and prices available.

With our team’s good standing with all major carriers, truckers, warehouses, brokers and agents worldwide, we are working hard to ensure that all of our partners & customers have confidence in their bookings and be sure their cargo is in good hands.

Our Team is continuing to work remote minimizing risk of exposure, as well as always being able to provide communication for all shipping needs.

Please feel free to reach out to us with any questions or concerns and we will be happy to shed light on the situation at hand.

Though times are tough for all, we wish everyone good health and well being as we tackle the problems seen around the world. Thanking you for your continued support and understanding.

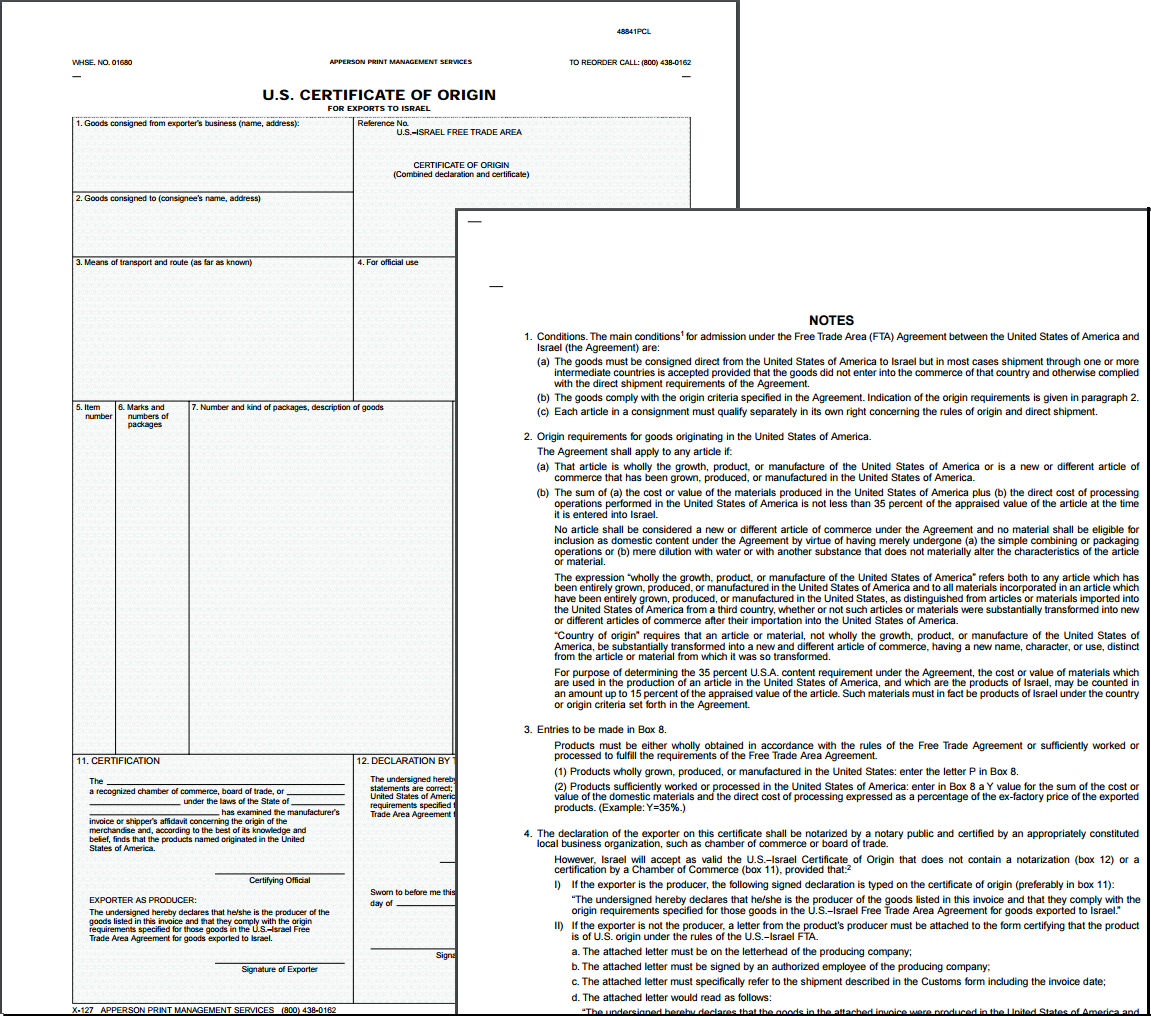

All U.S. goods exported to Israel must be accompanied by a U.S.-Israel Certi cate of Origin signed by the exporter. In order to benefit from the provisions of the U.S.-Israel FTA, a special "US Certificate of Origin for Exporting to Israel" must be presented to Israel Customs.

The certificate will need to be notarized and stamped.

The correct certificate of origin is a hard copy, green color form, with instructions printed on the back page. Apperson Store is the only supplier of the original: http://store.apperson.com/Print-Document-Management/import-export-forms/CERTIFICATE-OF-ORIGIN-ISRAEL_2.html

Apperson sells pads of this form. Some American-Israel Chambers of Commerce sell single forms but they charge $25 + for a single form while Apperson charges $98.50 for a package of 500 forms.

For single forms try any American Israel Chamber of Commerce at: http://www.israeltrade.org/

Hurricane Maria is regarded as the worst natural disaster on record for Puerto Rico.

Given the massive amount of goods being received in Puerto Rico and the logistics surrounding the relief effort EGL Maritime was happy to be of help in shipping of drinking water canned and donated by Escutcheon Brewing in November 2017.

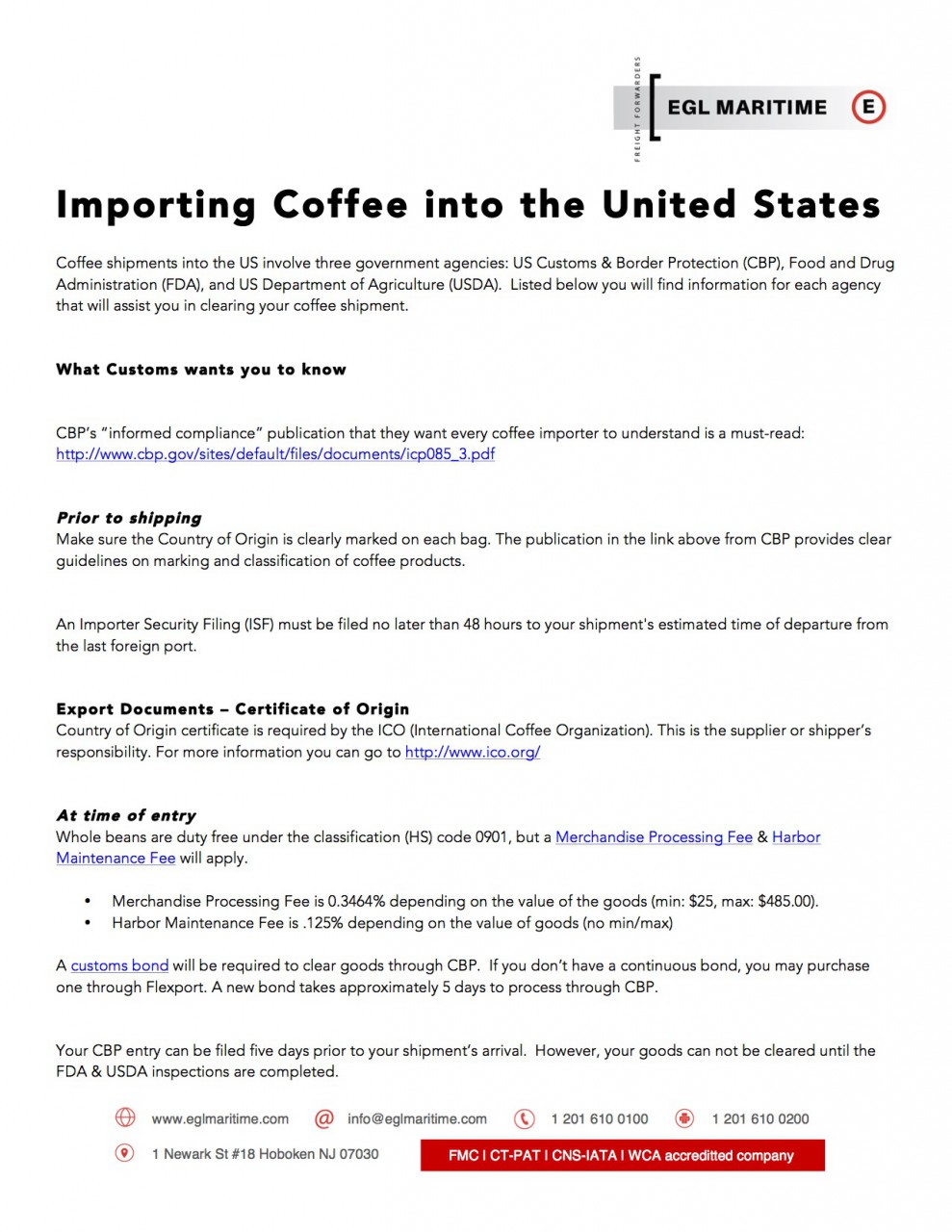

Coffee shipments into the US involve three government agencies: US Customs & Border Protection (CBP), Food and Drug Administration (FDA), and US Department of Agriculture (USDA).

We have created a step by step process with appropriate links in a 4 page pdf. Please email us at This email address is being protected from spambots. You need JavaScript enabled to view it. for your free copy.

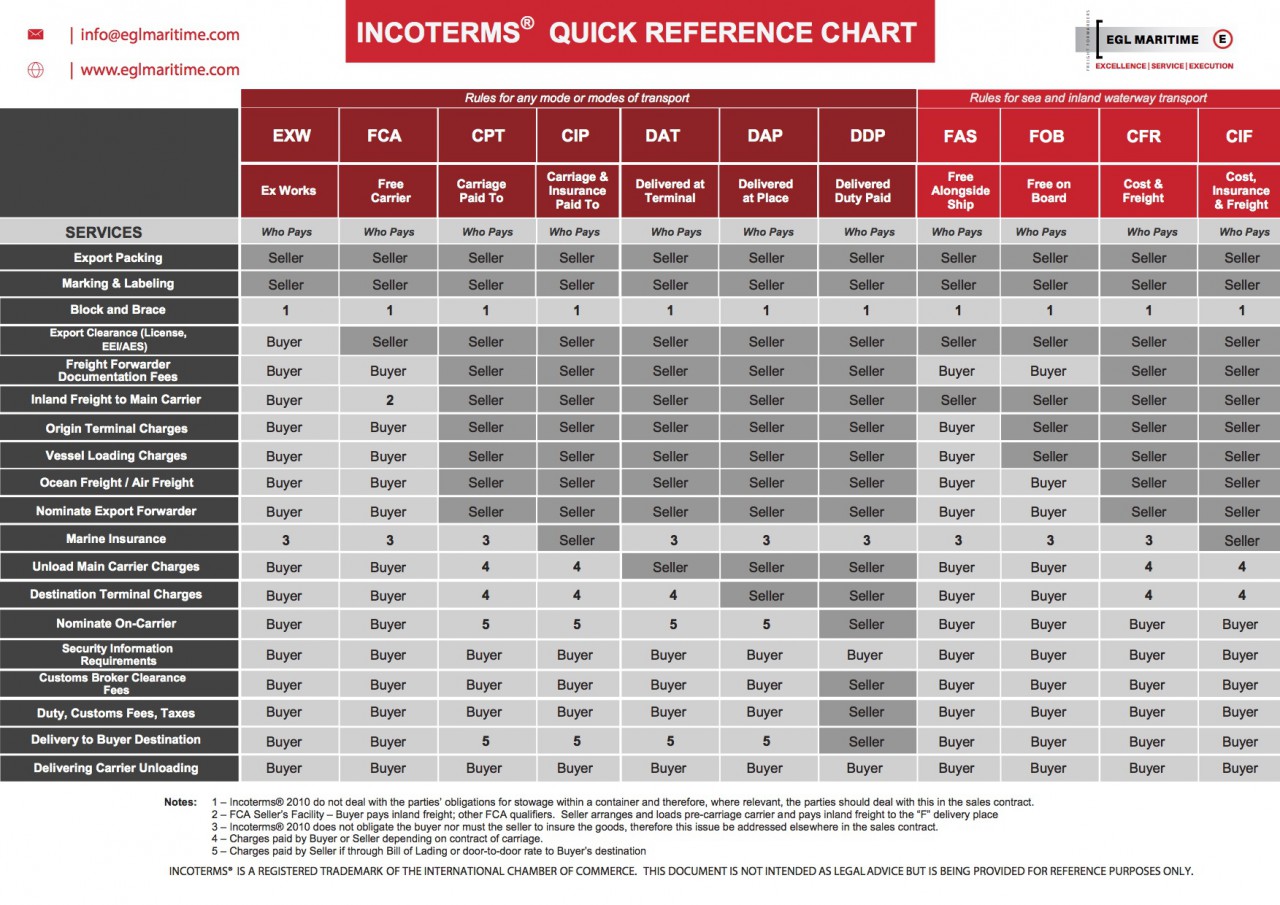

Freight incoterms are the standard contract terms used in sales contracts while importing/exporting to define responsibility and liability for shipment of the goods.

In plain English: How far along the process will the supplier ensure that the goods are moved? And at what point does the buyer take over the shipment process?

FOB (Free on Board) & EXW (Ex Works) are the most familiar incoterms but there’s much about these and the other options to learn. These terms can be confusing or easily misunderstood. Making the wrong choice might turn your shipment into an expensive nightmare.

We at EGL MARITIME have created an easy to understand chart to quickly give you the tools to make the right choice for your next shipment. Please click this link for more details and contact EGL MARITIME for your next international move.